It also lets users keep a mileage log according to the IRS’s requirements. Small to medium-sized businesses, eCommerce businesses that needs foreign transactions. Companies that deal with multiple currencies and need to add employee time in the invoice. Summer is a prime time for boosting sales, especially if your business is in an industry like fashion, travel or outdoor gear.But in order to capitalise on…

The HubSpot Customer Platform

One user expressed that they like that QuickBooks has more robust accounting features than most competitors. Some also explained that QuickBooks offers excellent expense-tracking features. We agree with this, and one of the features we like is that QuickBooks remembers the categories of items that have been entered previously. Additionally, you can create explicit rules to help QuickBooks correctly classify transactions automatically. If you can’t justify the $90-per-month QuickBooks Online Plus plan, you won’t get inventory management, because QuickBooks Online’s lower-tier plans don’t come with it. This could be a real shortcoming for small online retail businesses, for instance, that need to keep track of their products and the materials used to make them.

Bank Reconciliation

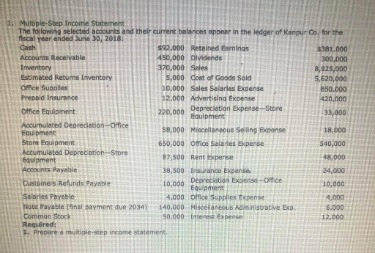

In this guide, we’ll compare Xero and QuickBooks head to head, looking at the pros and cons, features, fees and much more. In a nutshell, the Direct Technique involves subtracting the money spent from the money received. The Indirect Technique, on the other hand, calculates your operating cash flow using your Net Income and Depreciation.

Hevo – No Code Data Pipeline

Another benefit is that QuickBooks Online is better for small businesses, as you’re able to scale with your growing company. While Xero might be a good application to start with, growing businesses will appreciate the scalability offered by QuickBooks Online. The Contacts category lets you manage all contacts, from customers to suppliers to contractors, from one location. Reporting in Xero is solid, with a variety of financial statements and management reports available. QuickBooks Online came out on top for features, ease of use, customer support but Xero wins in pricing.

Customer Service and Support

Additionally, with QuickBooks Plus and Advanced, you can create custom reports. Across all pricing plans, you can also create custom tags for your reports. For example, you can’t use Xero to accept tips via invoices as you can with QuickBooks. On top of that, you can only convert quotes, not estimates, to invoices in Xero.

Fixed asset accounting is part of all Xero’s plans, while it’s offered only in the most expensive plan of QuickBooks Online—Advanced. Businesses with inventory items should choose accounting software that can track inventory costs, manage COGS, and monitor inventory units. We are driven by the Fit Small Business mission to provide you with the best answers to your small business questions—allowing you to choose the right accounting solution for your needs.

That means you can enter the transactions yourself or sync your account to a bank or credit card account to add transactions in real-time. Accounting software for your business can be an invaluable tool debits and credits for managing your expenses, monitoring your financial health, paying taxes, and more. QuickBooks boasts a vast ecosystem of integrations, covering everything from payroll to inventory management.

Other mutual features include receipt photo upload, mobile app mileage tracking, expense reporting and adding billable expenses to client invoices. You can also use the QuickBooks mobile app to track mileage and run expense reports and cash flow statements. From the desktop suite, you can set custom rules for categorizing all expenses. You can add billable expenses to the invoices you send clients via mobile or desktop. Xero is also ideal if you’re seeking accounting software that grows with you.

QuickBooks allows users to track and manage various expenses, including bills, checks, purchase orders, etc. Users can filter expense data by category, status, date, payee, and delivery method and view related information such as bills, expense claims, suppliers, and mileage. Xero updates the exchange rate every hour and revalues the company balance. It lets users view transactions, invoices, or bills in a foreign currency.

- Sign up to receive more well-researched small business articles and topics in your inbox, personalized for you.

- It’s an all-in-one solution for managing invoicing, expense tracking, and payroll, and it syncs with your bank accounts to keep data updated in real-time.

- Xero’s security measures keep your data encrypted and stored in multiple locations online, keeping it safe yet backed up.

- Sync data from your CRM, database, ads platforms, and more into Google Sheets in just a few clicks.

The platform’s bill pay tools are the best we encountered when reviewing accounting software. We especially like that you can use Xero to schedule batch payments in advance, whether for one vendor or several. Scheduling payments is an excellent way to avoid late fees, keep up with purchase orders, and keep your finances in top shape. Depending on several factors, including the size of your business and the type of business you run, either QuickBooks or Xero will be your best choice.

With QuickBooks, you can record the purchase of a fixed asset, but with Xero, you can track fixed assets, calculate and track their depreciation, and much more. Xero also has a more robust tool for tracking project profitability, giving you access to real-time reports. Additionally, Xero is a better choice for international businesses needing multicurrency support. QuickBooks Online also gives you the option to have customer payments applied automatically once they’re deposited, or leave that option to the user. QuickBooks and Xero are tied in this category because each platform offers features that the other one doesn’t. For instance, QuickBooks Online lets you accept payments but can’t record bills while Xero allows you to enter bills but can’t process online payments.

Most high street banks support international payments but they’re often expensive, slow and with limited features and currencies that you can send and receive. Businesses can now manage Invoices, Payroll, Bank Reconciliation, Purchasing, Expenses, Bookkeeping, and more, all in one application, thanks to Xero. Compared to QuickBooks, Xero’s time tracking features are easy to use. You can simply download the free Xero Projects app on iOS and Android, using it to record time and costs, as well as seamlessly and automatically feed the data into invoices and reports. Premium includes scheduling for jobs and shifts, real-time reporting, custom alerts, and time-off management.

If mobile payment is important to you, QuickBooks’ app might be better. If you often need to record bills and bill payments on the go, Xero’s mobile app might be preferable. Another reason QuickBooks Online stands out is its ability to calculate sales tax rates automatically based on the customer address, which is something Xero can’t do. Hence, it’s no surprise that QuickBooks Online is our overall best invoicing accounting software.

However, Xero only allows four total tracking categories — two active and two archived. All of the QuickBooks Online plans, on the other hand, let users create up to 40 tags. It also have customization options and continues to roll out new reporting what is a creditor features. Xero can integrate with more than 800 third-party applications, including tools for payments, subscription management, invoicing, payroll, CRM, and more. Xero has a clean, distraction-free interface where users can find what they want.

The app has a built-in timer you can use to record time as you work, or you can use the location-based job tracker through the mobile app. Xero also allows you to create a project or job, track time to add to it and add details to invoices when you’re ready to bill clients. If you upgrade to at least the Essentials plan from QuickBooks, you tax identity shield and tax fraud protection can enter employee time by client or project and automatically add that time to invoices. For more robust scheduling and PTO management, you’ll need to purchase the separate QuickBooks Time product in addition to the accounting software. QuickBooks can also track your mileage reliably and automatically using a GPS-enabled smartphone app.

Xero is more affordable and scalable than QuickBooks since all subscriptions have unlimited users. If you have a microbusiness and only need to manage and track a few bills and invoices, then you might do well with Xero’s Early plan. However, if you work with multiple vendors and customers and need more enhanced features, you should consider QuickBooks Online’s Plus tier. With a free plan and paid plans starting at $20 per month, Zoho Books has plans for most budgets. Higher-tier plans include unique features, like workflow rules, on top of tools that help you measure project profitability.